Small business owners’ digital servicing experience

I co-defined the UX/UI for a digital servicing experience for small business owners with the Capital One Spark Cash Plus card. The implementation has caused a 22% lift in decline-to-approval rates.

November 2022

Product design / User research / Prototyping

Figma

Background

Customers need to get a clear understanding of their account status and ways to resolve issues.

The research and design conducted informs how to best help small business owners remediate from transaction declines by focusing on information needs and visual hierarchy.

The decline widget has caused a 22% lift in decline-to-approval rates.

User problem

High-spend small business owners using the Capital One Spark Cash Plus card often experienced unexpected transaction declines. The online account page failed to:

Clearly show a decline occurred

Explain why it happened

Provide actionable next steps

This left users confused and frustrated, pushing them to call customer support. Declines eroded trust in the product and created costly service volume.

Hypothesis

If we show small business owners the clear path to view the details of recent declines on their account page, they will self-remedy without needing support.

Discovery

To test designs and gain more understanding on small business owners’ information needs, the team interviewed 41 customers who had high annual spend. In an unmoderated testing setting, small business owners shared background about their business, were introduced to product terms, went through a simulated online decline experience, interacted with two versions of post-decline design options, and sorted different types of information based on importance level. Participants answered questions regarding their post-decline reactions, needs, expectations, and their critiques of the two proposed designs.

Key Questions:

How do small business owners resolve a decline typically?

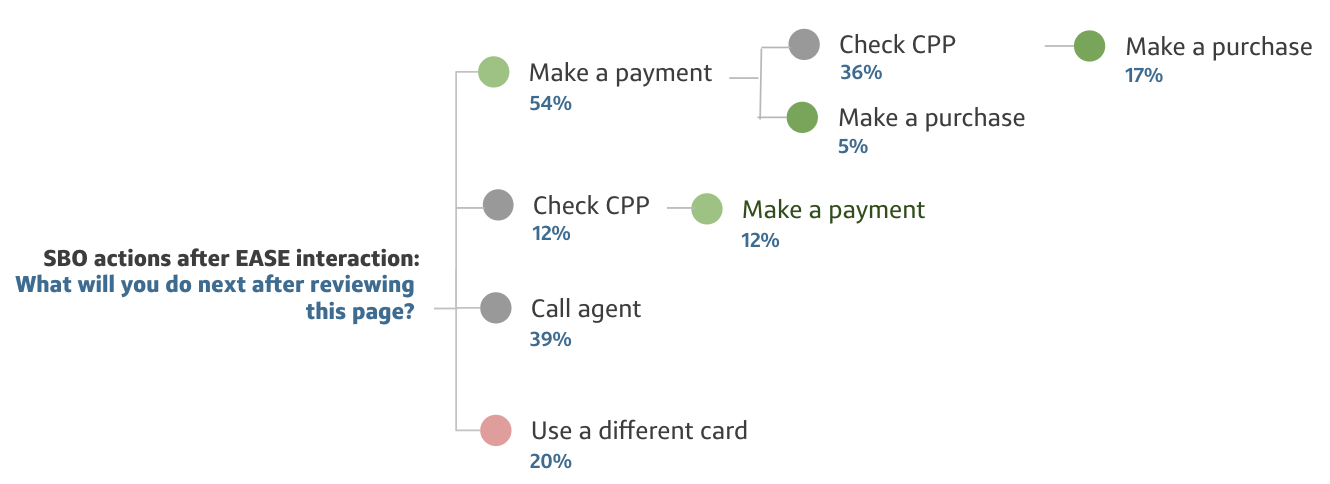

What would small business owners’ actions be after interacting with an in-app post-decline flow?

What information do small business owners’ need in order to resolve a decline?

Findings

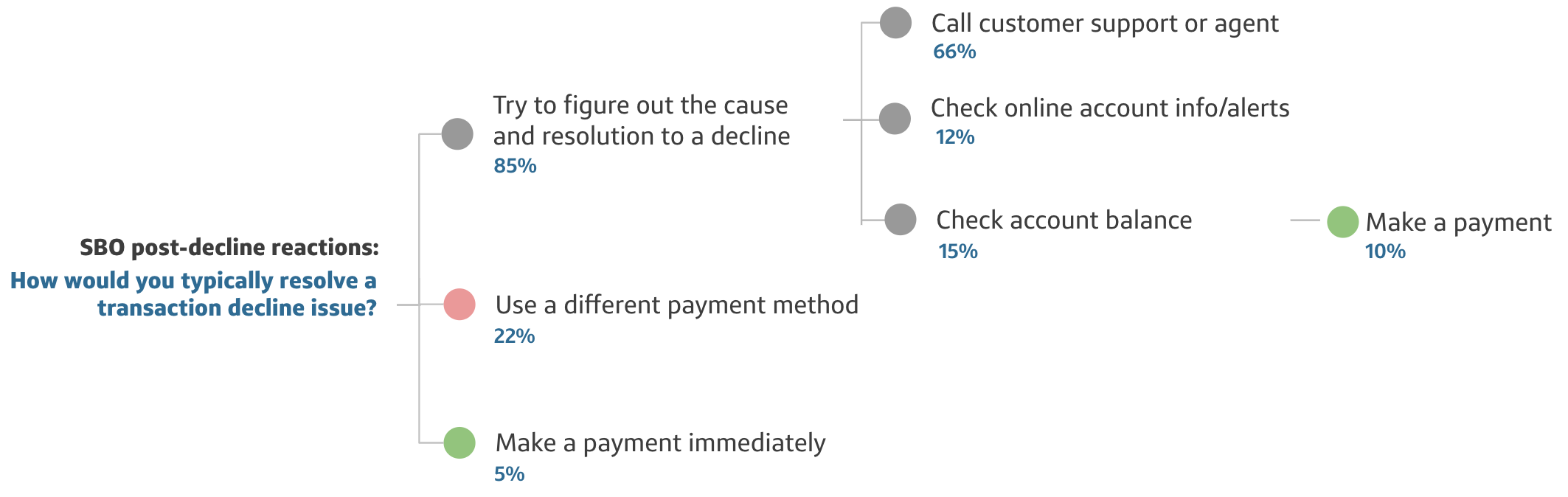

Customer insight : Small business owners’ want to figure out the cause / resolution for a decline through customer support or their account.

After being declined for a transaction, the vast majority (~85%) of small business owners first want to figure out the cause and resolution through customer support or checking their online account. The immediate actions after a transaction decline also depends on the situation. If a purchase is urgent, they are inclined to use a different payment method or if they had prior experience with a decline, they are more likely to make a payment first to resolve the issue.

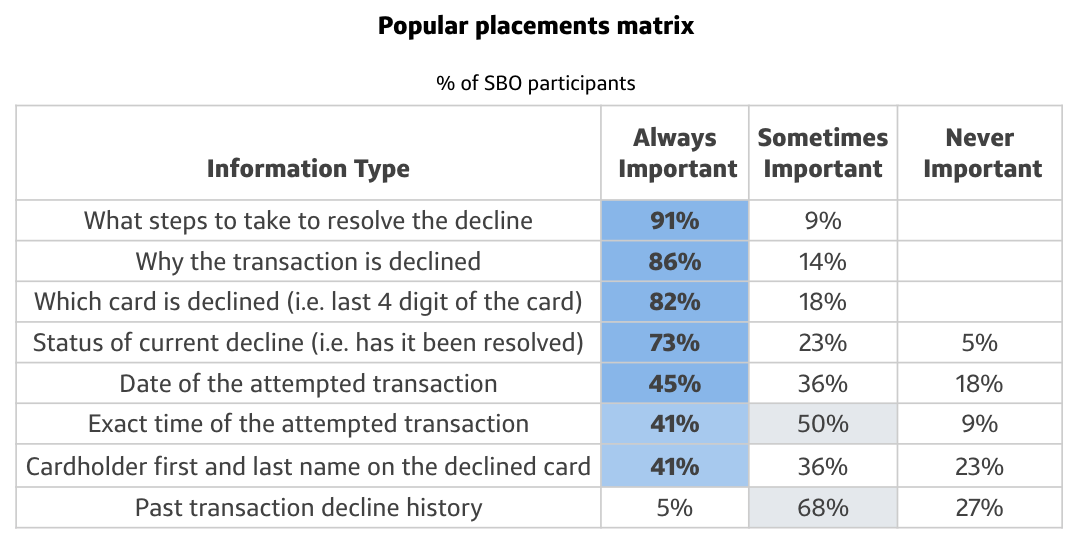

Customer insight : Customers want critical data about the decline and actionable remediation steps to follow.

Customers don’t want to be stuck in a decline state that would impact future purchasing. They find it always important to know what steps to take to resolve the decline, why the transaction is declined, which card is declined, who was declined, when the decline occurred, and the status of the current decline.

Methodology:

Unmoderated customer research

Card sorting for information needs

A / B testing for design preferences

→

→

Build out notification in the application so small business owners are aware of a decline happening and can self-remediate these issues.

Include critical information to notify the customer about the decline and its details in order to remediate.

Research

Design

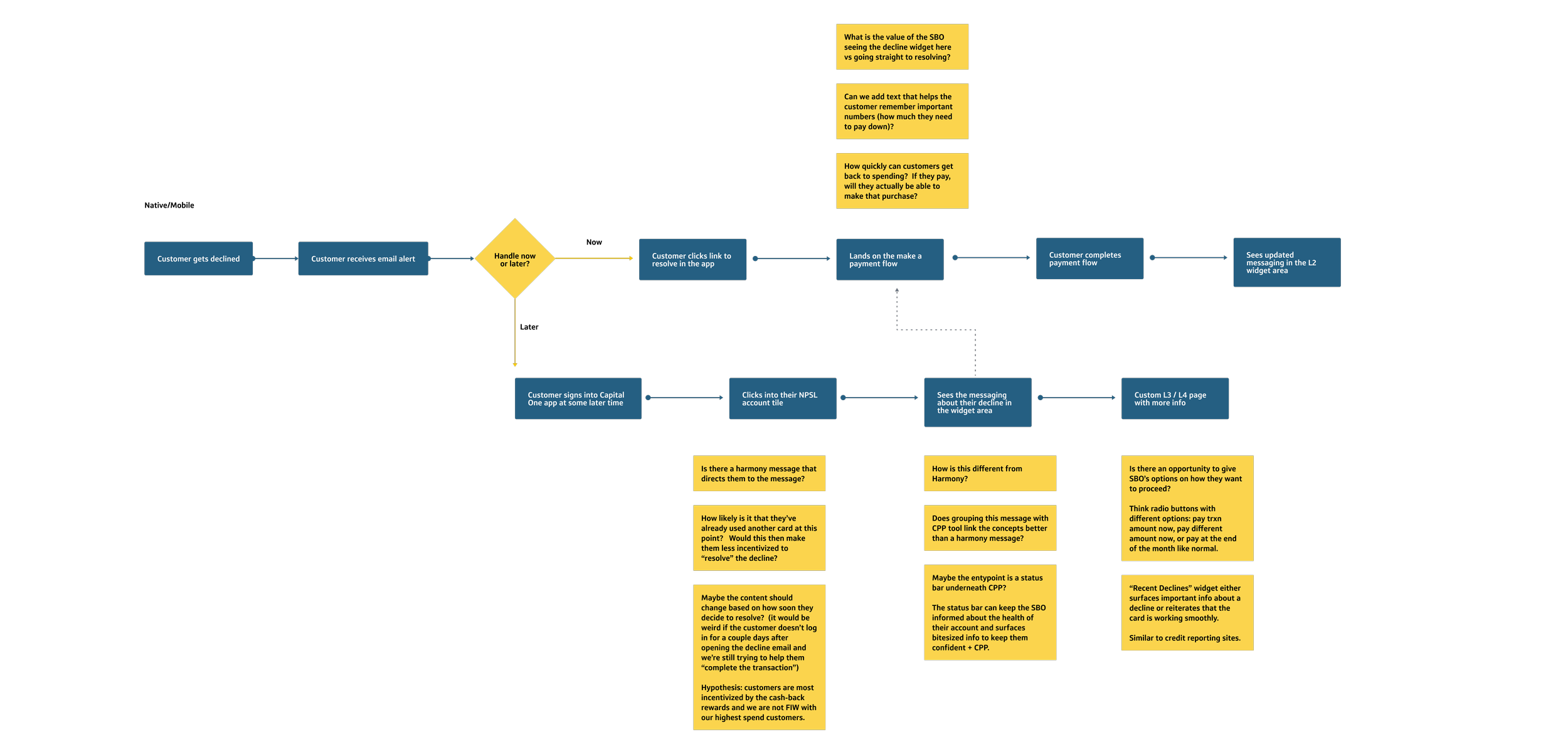

With these findings in mind, we developed a user flow in a low-fidelity format. The team was able to test the different hypotheses on what customer actions would be before investing in the full development of the UI. The initial plan to figure out which design was best was to compare the post-decline flow designs based on:

Findability: Can small business owners find decline-related information within their Capital One account?What information do small business owners’ need in order to resolve a decline?

Clarity: Can small business owners clearly understand their card status?

Usefulness: Is the page useful for resolving a transaction decline issue?

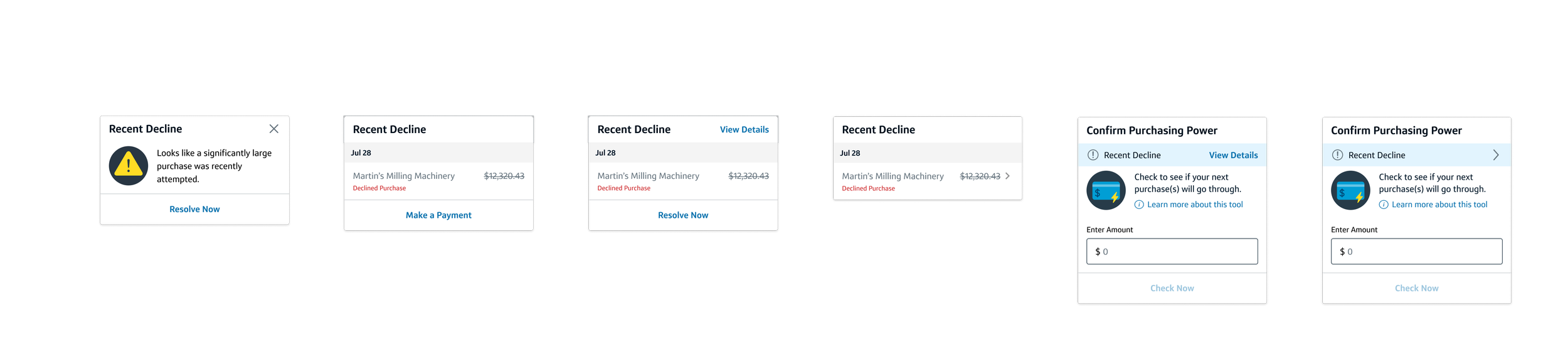

Brainstorming and A / B design comparisons

Various brainstorming concepts

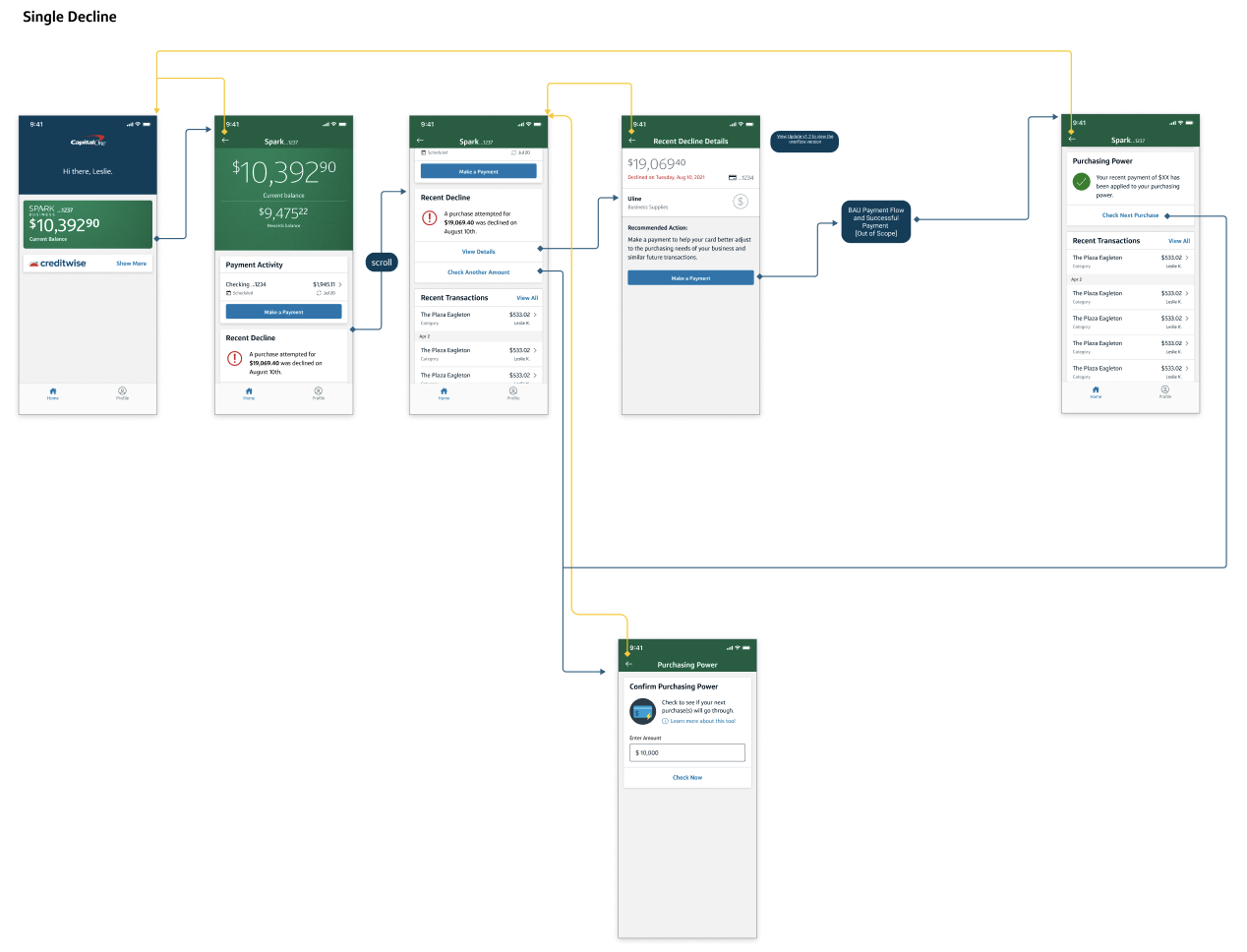

User flow

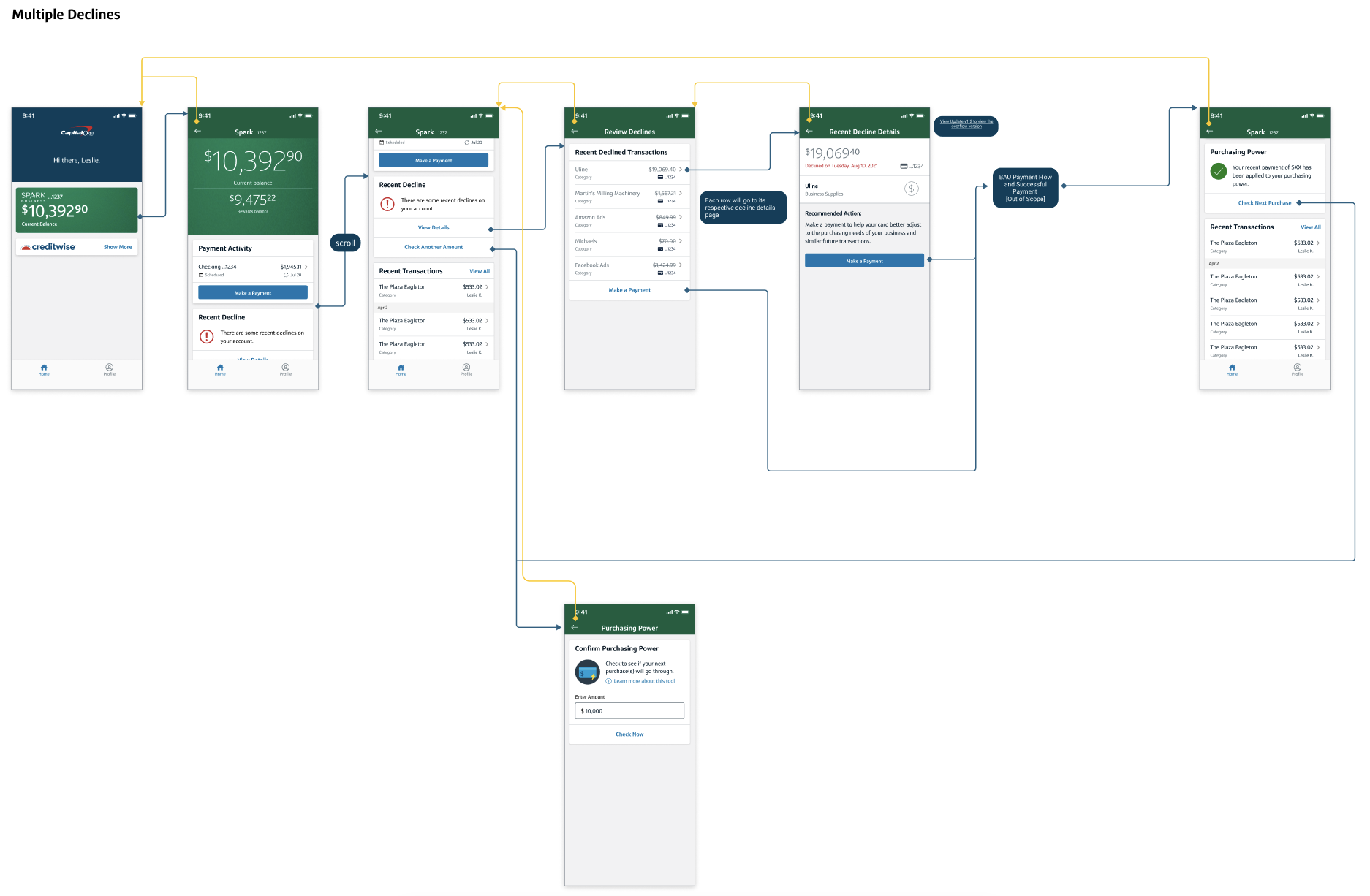

The different design flows were informed by the insights from customer research. To match existing styling to other patterns in the servicing experience, I used components to create the UI for the decline widget that would show up for both single and multiple declines within a customer’s account. This feature draws the customer’s attention to recent declines and allows them to learn more about the issue.decline widget that would notify small business owners about a decline within their Capital One account. The designs:

decrease in calling customer support and allows more self-servicing remediation

informs customers about a decline and its details all in one spot

After interacting with the post-decline flows, more small business owners said they would first make a payment to lower their balance. Whether a payment would be made immediately depends on situations such as small business owners having sufficient funds available or some small business owners prefer to pay at the end of their billing cycle.

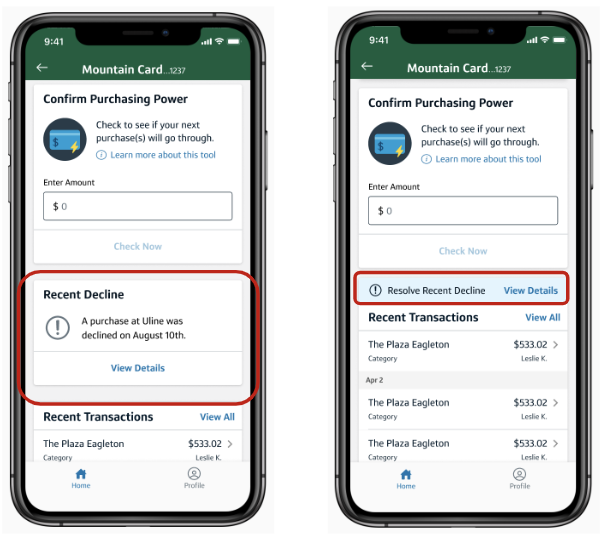

Version A and Version B

Several iterations of brainstorming helped determine the most effective ways to present all relevant information related to a decline. Through multiple stages of conceptualization and testing, we narrowed it down to two formats to ensure clarity and impact in conveying the information.

The difference in designs are the access points for a customer. Version A has a separate container widget containing high level decline details for a customer to view while Version B takes less space through a banner format.

100% of participants were able to find the decline widget while only 37.5% were able to find the decline banner. Participants noted that a separate container better communicates unusual account status rather than a banner that could be easily glossed over and thought of as another transaction.

Initial framework and user flow

Learnings

The decline widget serves a conceptual container component for more impactful messaging in the moment a customer experiences a decline. The new experience adds value, trust, and ease to customers. Real time engagement with small business owners designed to save them time to focus on their business. The strategy informs and guides small business owners in the moments that matter.

Results include:

22% lift in decline-to-approval rates

Decrease in calling agents and an increase in self remediation efforts